China’s Dominance in Mobile Payment Finance

China is undeniably the global leader in mobile payment finance, boasting the largest market size, cutting-edge technology, and widespread adoption that has reshaped financial ecosystems and consumer habits.

1. China’s Leading Performance in Mobile Payments

Market Size and Adoption Rate

China holds the world’s largest mobile payment market. According to iResearch, China’s mobile payment transaction volume exceeded 500 trillion yuan ($70+ trillion) in 2022, accounting for the majority of global mobile payments.

Mobile payments are deeply integrated into Chinese society, covering all age groups and regions. Whether in major cities or rural villages, mobile payments have become the primary method of transaction.

Major Payment Platforms

Two dominant platforms—Alipay and WeChat Pay—control China’s mobile payment ecosystem:

- Alipay: Operated by Ant Group, initially designed for Taobao transactions, has evolved into a super app integrating payments, financial services, and lifestyle solutions.

- WeChat Pay: Built into the WeChat social platform, WeChat Pay became widely adopted through its red envelope (hongbao) feature and is now a go-to tool for small transactions.

Technological Innovations

- QR Code Payments: China pioneered QR code payments, a low-cost, high-efficiency solution that has largely replaced cash and card transactions.

- Seamless Payments: Innovations such as license plate recognition and facial recognition payments have streamlined transactions in transportation and retail sectors.

- Cross-Border Payments: Alipay and WeChat Pay support multi-currency settlements, allowing Chinese travelers to use their mobile wallets globally and driving the global adoption of Chinese payment technology.

A New Financial Ecosystem

Mobile payments have gone beyond transactions to create a new financial ecosystem, fostering innovations like:

- Yu’e Bao: A money market fund within Alipay, offering users investment-like returns on idle cash.

- Huabei & Jiebei: Consumer credit services based on user transaction data, accelerating the adoption of digital lending.

2. Global Impact of Mobile Payments

1) Driving Financial Inclusion

Mobile payments have lowered barriers to financial services, empowering the unbanked population, especially in developing countries.

For example, in Africa, M-Pesa enables transactions through mobile SMS, significantly boosting financial inclusion and economic development.

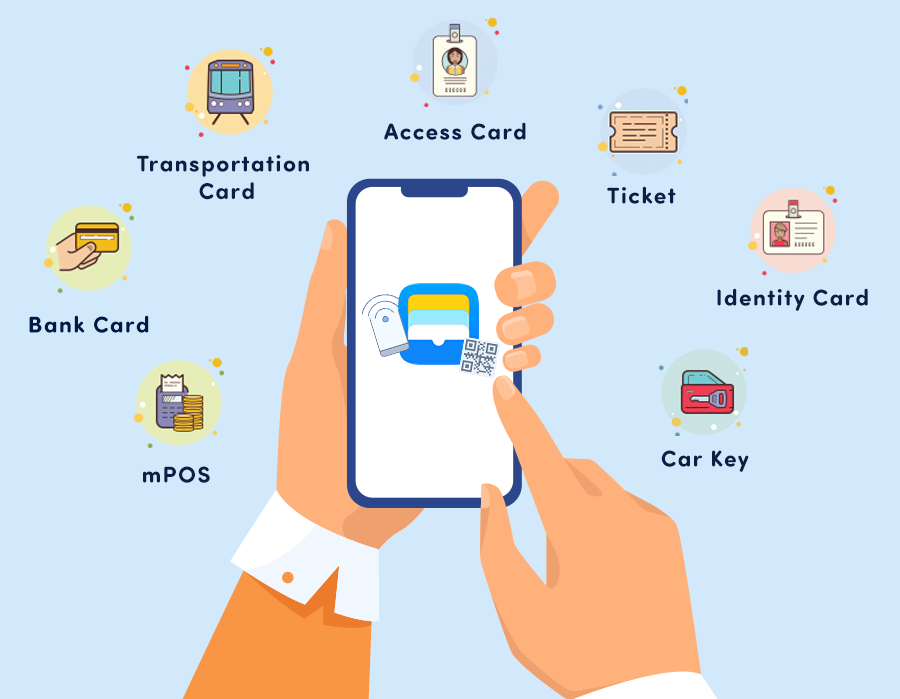

2) Changing Consumer Behavior

Mobile payments have transformed spending habits, accelerating the cashless society trend. Consumers no longer rely on cash or cards—transactions can be completed with just a smartphone.

This shift has increased transaction efficiency, fueled e-commerce growth, and enhanced the sharing economy.

3) Boosting SME Growth

Mobile payments offer low-cost financial solutions for small businesses, helping them manage cash flow and expand operations.

In China, small merchants and street vendors have digitized their operations through Alipay and WeChat Pay, improving efficiency and sales.

4) Driving Technological Innovations

The rise of mobile payments has accelerated innovation in:

- Blockchain

- Artificial Intelligence

- Big Data Analytics

These technologies have enhanced financial services, including risk assessment, fraud detection, and credit scoring.

5) Accelerating Globalization

Chinese mobile payment platforms are expanding internationally. Alipay and WeChat Pay are now available in dozens of countries, facilitating cross-border commerce and tourism.

Other nations are adopting China’s mobile payment model, accelerating the modernization of global payment infrastructures.

6) Challenging Traditional Banking

The mobile payment boom poses a major challenge to traditional banks and financial institutions. Banks are now forced to accelerate digital transformation to compete with fintech giants.

Additionally, the rise of mobile payments has raised concerns about data security, privacy protection, and financial regulations, prompting governments to implement stricter policies.

3. Future Outlook of Mobile Payments

1) Technological Advancements

With 5G, AI, and blockchain, mobile payments will become even smarter and more secure.

2) Global Expansion

Chinese mobile payment platforms will continue expanding overseas, fostering a globally interconnected payment ecosystem.

3) Stricter Regulations

Governments worldwide will enhance regulatory frameworks to ensure data security and user privacy.

4) Financial Innovation

Mobile payments will inspire new financial products and services, further transforming how people interact with financial systems.

Conclusion

Mobile payments have revolutionized finance, commerce, and daily life on a global scale. While China remains the dominant force, the industry’s influence continues to grow, reshaping economies, empowering businesses, and redefining the future of finance.